The UK’s digital advertising ecosystem continues to thrive, outpacing the broader economy with double-digit growth, and video and podcast advertising are playing central roles in this surge.

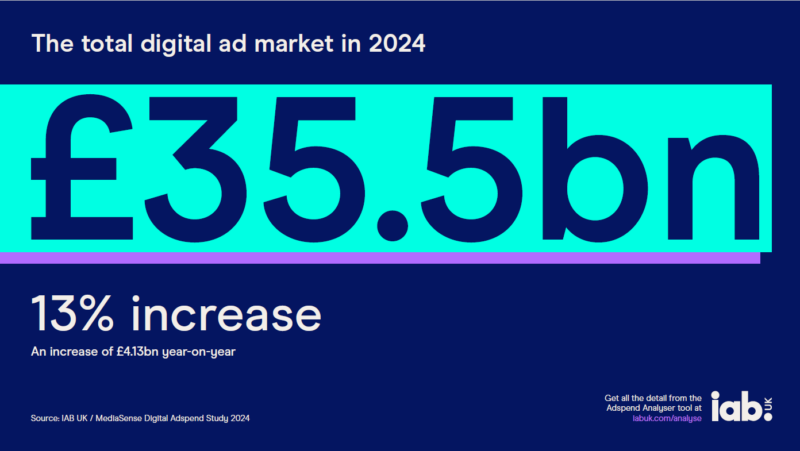

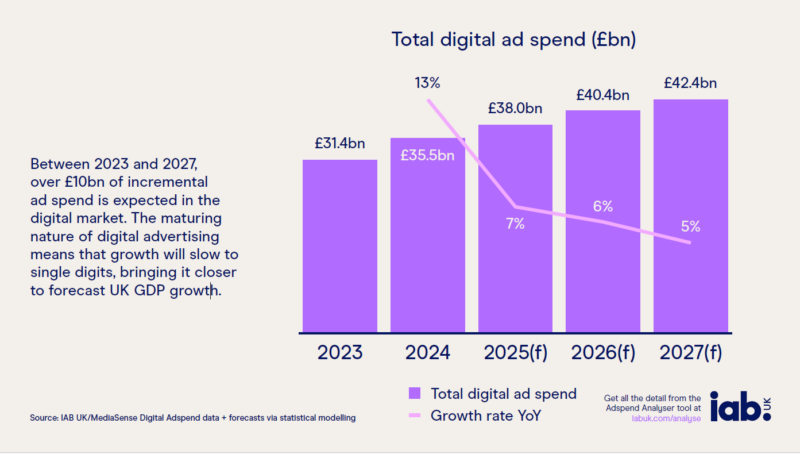

According to IAB UK’s latest Digital Adspend report, developed with MediaSense, total UK digital ad spend reached an impressive £35.6 billion in 2024, marking a 13% year-on-year growth, far outstripping the national GDP growth of just 1.1%.

The data paints a vivid picture of where advertisers focus their attention: increasingly, that focus is on video and audio formats, with mobile and connected TV (CTV) leading the way.

Podcasts: Steady Growth Amid Market Maturity

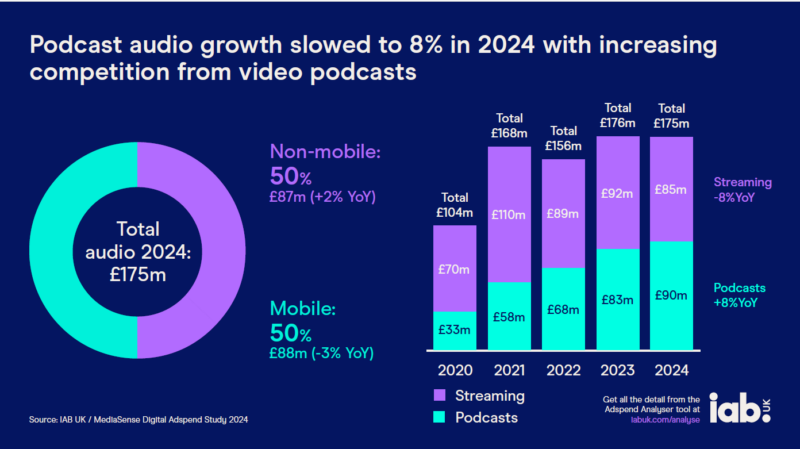

While podcast advertising experienced explosive growth in previous years, 2024 still saw a respectable 8% increase, bringing UK podcast ad spend to £90 million. This points to a maturing market where audio content, particularly spoken word and long-form storytelling, continues to capture loyal and engaged audiences.

Though slower than 2023’s 23% rise, the growth confirms podcasts remain a valuable channel for advertisers looking to build trust, drive brand affinity, and connect with niche demographics. Notably, this figure covers only audio podcast advertising, not the growing segment of video podcast ads, which are tracked within the digital video category.

Video Display: The Powerhouse Format

Digital video display ads grew by a staggering 20%, hitting £8.3 billion in spend. They now represent 64% of all online display advertising, up from just 51% five years ago—a clear signal that video is the preferred format for capturing attention and telling brand stories.

Mobile continues to lead as the dominant device, pulling in £6.1 billion in video ad spend. Still, connected TV (CTV) saw the fastest growth rate at 22%, reflecting changing viewing habits and the ongoing shift from linear to digital.

Audiences Are Leading the Charge

The growth in video and podcasting aligns directly with consumer behaviour. According to GWI data, all UK age groups under 55 now spend more time watching digital video than linear TV, and podcast consumption remains strong, particularly among young adults and multitasking mobile users. This attention shift allows advertisers to reach audiences more contextually and meaningfully.

What This Means for Advertisers

The data reinforces a powerful reality: audio and video complement traditional media and are now essential to digital strategy. Audio, in particular, offers substantial mid- and upper-funnel value, driving engagement, brand recall, and — increasingly — conversion.

Advertisers are urged to adopt multi-format, cross-channel approaches that reflect real audience behaviour. As Jon Mew, CEO of IAB UK, put it:

“Whether you’re watching a podcast on your phone or streaming YouTube on the TV, how we consume media is becoming increasingly video-centric… We expect to see advertisers’ shift to video accelerate over the coming years as new technology diversifies our screen choices and barriers between different media channels continue to erode.”

Looking forward, IAB UK forecasts digital ad spend will grow another 7% in 2025 to hit £38 billion, with digital video poised to make up 27% of the market by 2027.

While video may be grabbing the headlines, podcast advertising continues to be a cost-effective, trust-building channel, with growing influence in the broader digital mix. Audio remains a sound investment for advertisers aiming to cut through the noise and connect with audiences in personal, immersive ways.

Source: IAB UK website.

Download the report here.