Audio in 2025: Evolving Habits in a World of Infinite Choice

As audio content becomes more diverse and accessible than ever, listeners’ expectations are shifting. From once being limited to live radio and physical media like vinyl or CDs, today’s audiences enjoy an endless stream of personalised playlists, niche podcasts, and curated radio across multiple platforms. This blog highlights key insights from Ofcom’s 2025 Audio and Podcast Surveys, enriched with RAJAR and Edison Podcast Metrics UK data. It provides a comprehensive overview of how UK audiences interact with audio in all its modern forms.

In the digital age of abundance and personalisation, the UK’s audio landscape is undergoing a remarkable transformation. Ofcom’s latest 2025 Audio and Podcast Survey, supplemented by RAJAR data and Edison Podcast Metrics UK, presents a picture of a thriving, multifaceted audio market that continues to evolve in response to changing consumer habits, technology, and content formats. Online music services now rival radio in weekly reach.

Source: Audio listening in the UK, 2025, Ofcom

Audio remains central to daily life. 93% of UK adults tune in weekly, rising to 98% among 16– to 34–year–olds.

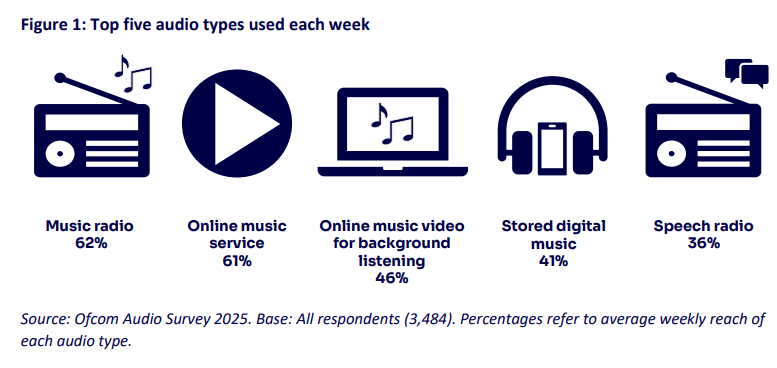

- Online music services (61%) are now tied with music radio (62%) as the top weekly audio choices.

- Other formats include music videos (46%), downloaded tracks (41%), and speech radio (36%).

- Physical formats like CDs, vinyl, and tapes are still used weekly by 27%, while a third (33%) never use them.

With audio consumption evolving rapidly, platforms like Spotify and Amazon Music are now just as prominent as traditional radio in the UK listening landscape.

Source: Audio listening in the UK, 2025, Ofcom

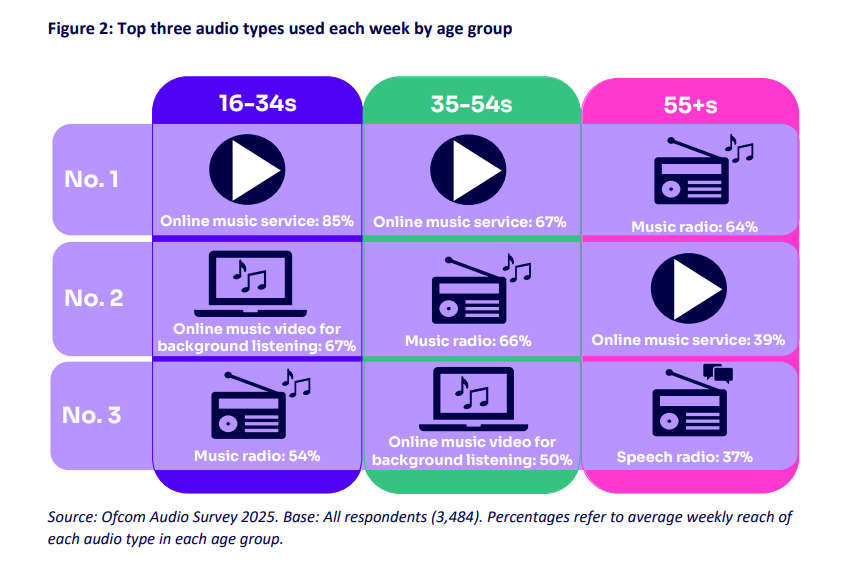

One of the standout insights is that music streaming services now attract as many weekly listeners as traditional music radio, with around 60% of UK adults aged 16 and above engaging with both formats. However, the generational gap is stark—younger listeners are more than twice as likely to stream music as those aged 55 and above, highlighting a generational shift toward on-demand, personalised listening.

Smart Speaker Listening: Live Radio Still Leads, But Not for Everyone

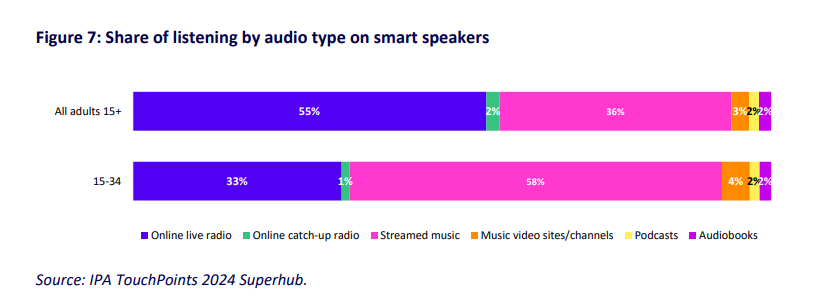

Voice technology is reshaping how people access their favourite audio. Over 70% of voice assistant users (e.g., Amazon Alexa, Google Assistant, Siri) utilise these tools to listen to radio and other audio types, such as streaming or podcasts. Smart speakers dominate this space—over half of all radio-related voice requests happen on smart speakers, while only 20% come via smartphones. Live radio remains the top choice on smart speakers, making up 55% of total listening time, followed by streamed music at 36%.

Source: Audio listening in the UK, 2025, Ofcom

However, among 15–34-year-olds, the trend reverses: streaming dominates at 58%, while live radio usage drops to 33%. Smart speakers are becoming key audio devices, but age shapes listening habits.

This trend highlights the increasing importance of voice-enabled devices in shaping home listening habits.

Podcast Listening: Growing, Then Settling

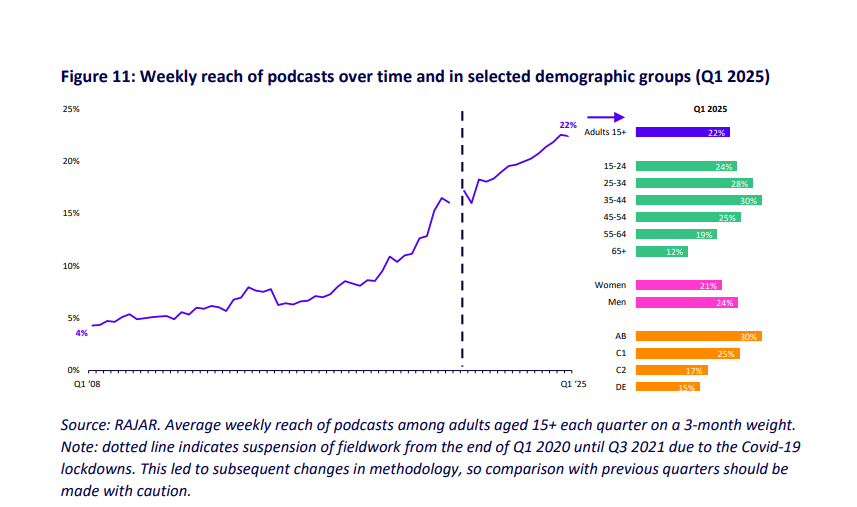

Podcasts now reach just over 22% of UK adults, showing steady but gradual growth that seems to be levelling off. The data suggest that podcasts and radio cater to different listener needs.

Source: Audio listening in the UK, 2025, Ofcom

Podcasts are more commonly enjoyed on personal devices, such as smartphones, while music radio remains a shared household experience, accessed via radios or smart speakers.

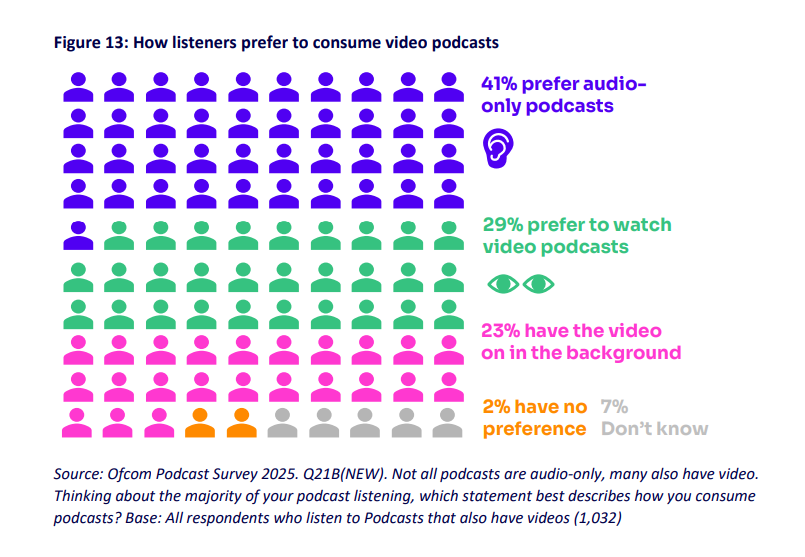

Audio or Video? How Listeners Consume Podcasts

While many podcast fans remain loyal to audio-only formats, video podcasts are gaining traction, especially as more shows expand to visual formats. Sixty-nine per cent of podcast listeners have consumed video podcasts, and 37% do so on a weekly basis. When asked about preference, 41% still prefer audio-only, 29% would rather watch the video when available, and 23% play the video in the background.

Source: Audio listening in the UK, 2025, Ofcom

Platforms like YouTube and Amazon Music attract more viewers who actively watch video podcasts, unlike Spotify and BBC Sounds, where the audience shows no strong preference for video, despite Spotify’s growing video offerings. In short, convenience and multitasking still make audio the go-to option, but video is carving out its own space, especially when users are on visual platforms.

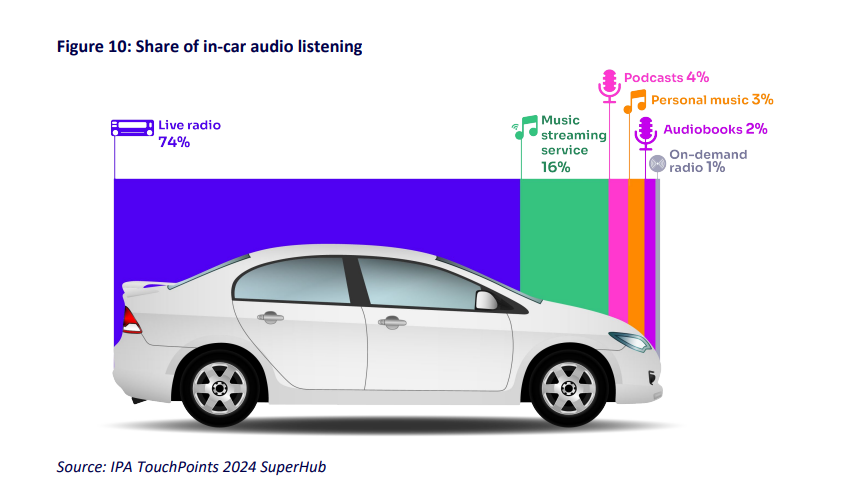

In-Car Listening Gets a Digital Upgrade

Cars—once the last stronghold of physical formats and linear radio—are also undergoing a listening revolution. A fifth of all in-car audio time is now spent on streaming services or podcasts.

Source: Audio listening in the UK, 2025, Ofcom

Between 2018 and 2024, in-car music streaming increased by eight percentage points, primarily at the expense of traditional radio (down 7 percentage points) and physical media, such as CDs and cassettes (down 3 percentage points).

The Bigger Picture: Choice is the New Norm

What’s clear across all data is that listeners’ expectations are evolving. Where once audio meant linear radio or physical media, today’s consumers are immersed in a rich ecosystem of algorithmically personalised playlists, hyper-niche podcasts, and curated online radio stations—offering music and stories to suit any mood, time, or taste.

As brands and advertisers adapt to this dynamic landscape, understanding listener behaviour across platforms, especially ad-supported audio, will be key to capturing attention and driving results. Want to explore more UK audio trends?

Download the full version of the report to check out the full Ofcom and RAJAR findings for deeper insights.

Source: Audio listening in the UK, 2025, Ofcom