November heralds the commencement of International Games Month, a dedicated period to pay tribute to the global gaming community and bring together gamers of all ages and backgrounds who share a common passion for interactive entertainment.

It is a fantastic opportunity to gather with friends, family, or strangers for friendly competition. Whether your preferences lean towards board games, card games, video games, or physical activities, there’s something for everyone to enjoy this month. Only let this chance slip by with creating some delightful memories through good old-fashioned gaming!

And if you are interested in games as an advertiser, we want to share something else with you.

We’re thrilled to present invaluable insights and strongly encourage you to delve into the Key Takeaways from Gaming Spotlight 2023: Exploring the Evolving Gaming Landscape, a report jointly crafted by DATA.AI and IDC.

The gaming industry remains in a state of constant evolution, offering both opportunities and challenges in a swiftly changing landscape. Here are the primary highlights that illuminate the current status and future prospects of the gaming market as revealed in the report:

Evolution of Gaming Preferences: Core Games Prevail as Emerging Genres Emerge

In the ever-evolving landscape of gaming, core games continue to maintain their dominance. These are games characterized by real-time online multiplayer features, prominently player-versus-player (PvP) modes. Notably, core games such as Battle Royale and Shooting Games remain at the forefront across various platforms, including mobile and PC/Mac.

- Mobile and PC/Mac: The enduring popularity of core games with real-time online multiplayer features is evident, with titles like Battle Royale and Shooting Games continuing to captivate players. These genres consistently secure top positions in the gaming hierarchy, showcasing the sustained demand for competitive gameplay.

- Nintendo Switch Lite: The gaming community has witnessed the prominence of first-party games priced at $60, asserting their dominance on the Nintendo Switch Lite platform. In a noteworthy development in Q1 2023, Sega’s Sonic Frontiers secured the 15th position among the highest-grossing third-party games, indicative of diverse gaming preferences. Additionally, the resurgence of evergreen titles, like the debut of Mario Kart 8 Deluxe in Q2 2017, further illustrates the cyclical nature of gaming trends.

- Steam: The Steam platform has seen its share of noteworthy trends. Two first-party free-to-play games, CS:GO and Dota 2, have consistently held positions in the top five rankings. Furthermore, H1 2022 witnessed robust sales of titles such as Elden Ring and Dying Light 2: Stay Human, underlining the appetite for engaging gaming experiences. Interestingly, Call Of Duty Modern Warfare 2 (2022) made a return to Steam and demonstrated solid performance in Q4 2022. Battle and season passes, widely popular in-game monetization mechanisms, have consistently proven their value.

Mobile Gaming Remains a Lucrative Opportunity

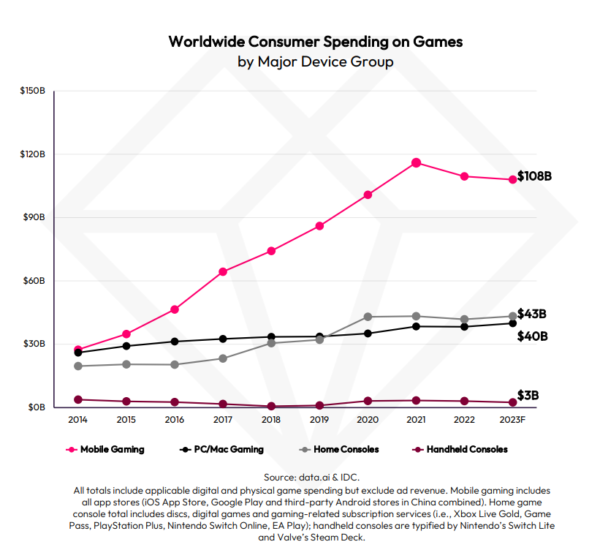

Mobile gaming remains the largest opportunity in the gaming industry. Despite ongoing updates to privacy regulations, macroeconomic instability, and the increased competition in the mobile gaming space, it continues to be a thriving market. The challenge lies in finding new users and setting revenue expectations as the industry becomes more competitive.

Rising Competition in Mobile Gaming

Competition in the mobile gaming sector is constantly increasing. While mobile consumer spending is expected to remain relatively consistent in 2023 compared to the previous year, it’s more critical than ever for companies to stand out in this crowded marketplace. Staying ahead of industry trends is vital to maintain a competitive edge.

Varied and Demanding Mobile Gamers

Today’s mobile gamers are a diverse and demanding audience. It’s no longer enough to rely on popular trends, as mobile gamers have diverse interests and preferences. Staying updated on popular features and revenue-driving updates is crucial for retaining daily active users (DAU) and enhancing player engagement. This necessitates the right partnerships to gain visibility on competitors.

Creative Optimization as a Key Strategy

With the rising acquisition costs in mobile gaming, creative optimization becomes even more impactful. Understanding how competitors effectively convert players and the factors driving their creative strategy can fuel a company’s asset and network strategy for growth.

Diverse Monetization Options

There are more monetization options available in the gaming industry than ever before. These include ad revenue, subscriptions, battle passes, promotions, and various other models. Maximizing revenue potential requires a comprehensive approach to monetization. Understanding what performs well in your genre for your users is essential for staying ahead in the market.

Mobile Spending Decline and Privacy Concerns

While mobile gaming is a lucrative market, there is a leveling out of mobile spending. Several factors contribute to this trend, including the introduction of privacy regulations like App Tracking Transparency (ATT) and a crackdown on fingerprinting. These changes make it more challenging to target high-spending users (“whales”) and monetize through in-app purchases (IAP).

Growth in Home Console Spending

Home console spending is expected to rise by 3% in 2023, reaching $43 billion. This growth is attributed to increased spending on consoles like the PS5 and Xbox Series X/S, which offsets the decline in spending on the Nintendo Switch.

Rising PC/Mac Spending

Spending on PC and Mac games is projected to increase by 4% in 2023, reaching $40 billion. This growth is mainly driven by the rise in subscription-based game revenue.

Cloud-Streamed Gaming on the Rise

Cloud-streamed gaming (CSG) is making inroads on mobile platforms. It is expected to represent 26% of global hours spent gaming on smartphones and tablets in 2023, up from 16% in 2019. Global consumer spending on CSG services is projected to reach $3.8 billion in 2023, indicating substantial growth in this sector.

Evolving Game Genres

While core games with real-time online multiplayer features, such as Player vs. Player (PvP), remain popular across different platforms, new genres are emerging. Games like Battle Royale and Shooting Games continue to dominate the market. On different gaming platforms, various titles and genres are gaining traction, making it essential for developers to adapt to changing player preferences.

In conclusion, the gaming industry continues to offer significant opportunities for growth and innovation. However, companies need to navigate challenges such as privacy regulations, increased competition, and diverse player preferences to thrive in this dynamic landscape. Staying informed about industry trends and implementing effective monetization and user engagement strategies will be crucial for success in the gaming market.

Source: The GAMING SPOTLIGHT 2023