Europe’s digital audio advertising landscape is on the cusp of a significant transformation. As revealed in the “The Evolution of Digital Audio Advertising in Europe” report, jointly released by IAB Europe and GroupM in October 2023, the industry is experiencing remarkable growth and evolving at a rapid report provides valuable insights into the current state of digital audio advertising, the opportunities it presents, and the key drivers shaping its future. Let’s dive into the key takeaways from this comprehensive study.

The Resilient Growth of Digital Audio

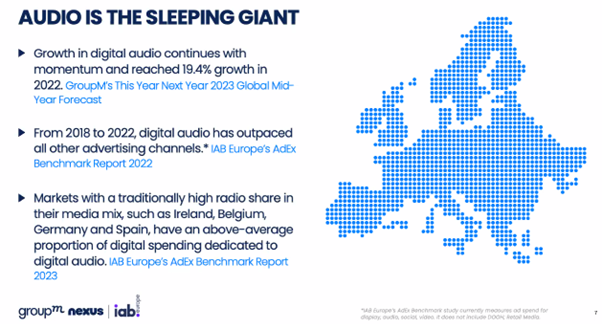

GroupM’s “This Year Next Year 2023 Global Mid-Year Forecast” sets the stage by emphasising that digital audio’s growth remains steadfast. In 2022, it experienced a remarkable 19.4% growth, and this trajectory shows no signs of slowing down. Interestingly, the report points out that markets with traditionally high radio shares, such as Ireland, Belgium, Germany, and Spain, allocate a substantial portion of their digital spending to digital audio.

A Glimpse into the Past

IAB Europe and GroupM Nexus were surveyed in 2019 to understand the evolution of programmatic audio in Europe. They revisited the landscape four years later to gauge its evolution and identify emerging opportunities. Their survey aimed to uncover the following:

- Knowledge Levels: To assess the current understanding of digital audio campaign planning, buying, and selling among stakeholders in the buy and sell side.

- Investment Levels: To determine the current levels of digital audio advertising investment, key formats favored for investment, and expectations for future growth.

- Key Drivers and Barriers: To identify the primary drivers behind digital audio advertising investments and the potential obstacles hindering its growth.

Listening Trends

One of the key findings was related to listening habits. 54% of respondents said they listen to more digital audio than other media channels. A noteworthy 24% spent approximately the same time on digital audio, while 22% reported listening to less digital audio.

Room for Growth

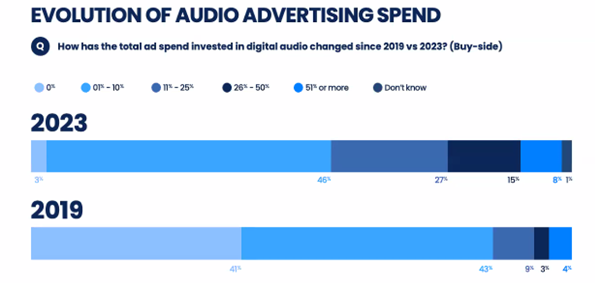

Despite the upward trajectory, the report highlights that digital audio advertising is still emerging. The survey revealed that 73% of buy-side respondents allocated between 1-25% of their total ad spend to digital audio, and 24% committed 11-25%. These numbers indicate that digital audio advertising is still nascent regarding overall advertising budgets.

However, there is room for optimism. In 2019, only 4% of buy-side respondents allocated over 50% of their ad budgets to digital audio. In 2023, this number doubled to 8%, showcasing the increasing prominence of digital audio in the advertising landscape.

Mobile Dominance

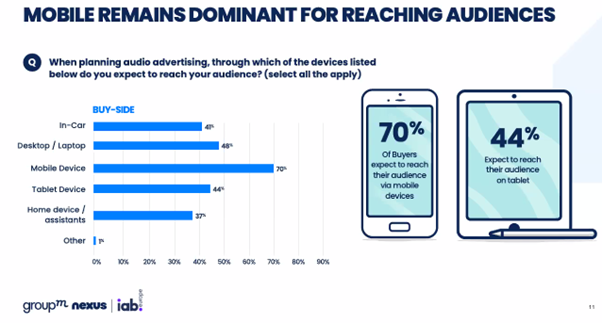

The study also delved into the devices through which digital audio ads reach their audiences. Notably, mobile devices dominate, with 70% of buyers expecting to connect with users through this platform. Desktop/laptop (48%), tablets (44%), in-car (41%), and home assistant/devices (37%) followed closely. The study resonates with publishers, with 84% expecting to reach audiences through mobile devices.

Key Metrics

Digital audio advertisers are focusing on specific metrics to gauge their campaign success. The top three metrics selected by both buyers and publishers are reach and frequency, brand awareness, and advertising/campaign recall. Sales key performance indicators (KPIs) were ranked as the least important metric for both groups: advertisers and publishers.

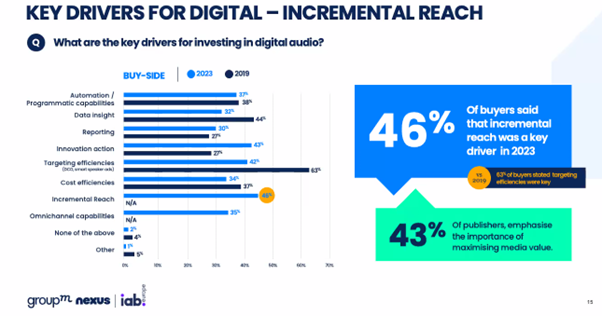

Building Brand Metrics

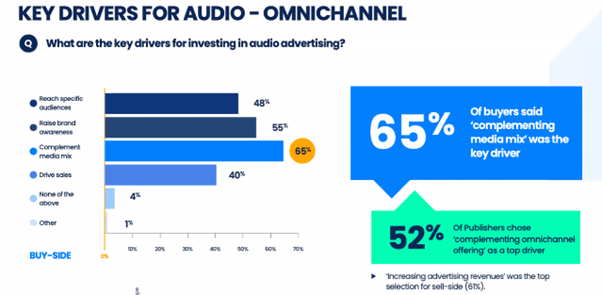

Another critical insight reveals that audio advertising is pivotal in complementing omnichannel media plans and driving brand metrics. The majority of respondents see it as vital to their media plans, with key drivers being:

- Complementing the media mix (65%)

- Raising brand awareness (55%)

- Reaching specific audiences (48%) Interestingly, driving sales was ranked as the least important driver, highlighting the broader role of digital audio in branding and engagement.

The Future of Digital Audio

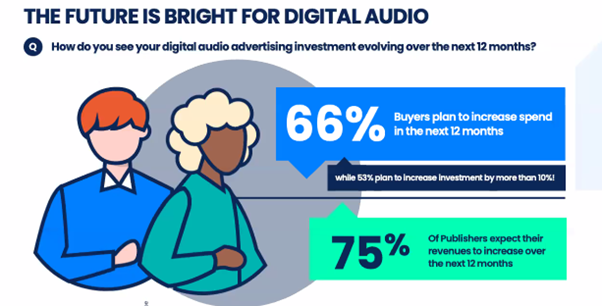

The report unveils the collective optimism of both buy-side and sell-side respondents. About 66% of buyers expect to increase their digital audio advertising spend over the next 12 months, with 24% expecting growth between 11-30%. A longer-term view, spanning 18-24 months, is even more optimistic, with 74% anticipating increased planning and spending on audio advertising.

According to the report, smart speakers, dynamic audio ads, omnichannel insights, and advanced contextual targeting are perceived as the most substantial opportunities for future growth.

The Road Ahead

In conclusion, the “The Evolution of Digital Audio Advertising in Europe” report offers a valuable snapshot of the evolving landscape of digital audio advertising. It highlights the substantial growth of digital audio and its expanding role in advertisers’ strategies. While challenges exist, such as ad frequency and relevance, this report paints a promising picture of the digital audio advertising arena and positions it as a critical player in the media ecosystem. As we progress, digital audio advertising will be a pivotal channel for engaging audiences and building brand awareness in Europe and beyond.

Tune in to the webinar co-hosted by IAB Europe and GroupM Nexus, featuring a deep dive into the captivating realm of Digital Audio Advertising. In this immersive event, industry experts uncovered the essential insights from the report, illuminating the continuously evolving Digital Audio Advertising landscape. Download the full report here.