In the ever-evolving landscape of online marketing, one segment continues to stand out in the US: digital audio. According to the 2023 IAB Internet Advertising Revenue Report by PwC, digital audio, comprising podcasts, streaming radio, and online music services, experienced the most robust growth rate of any online media for the second consecutive year.

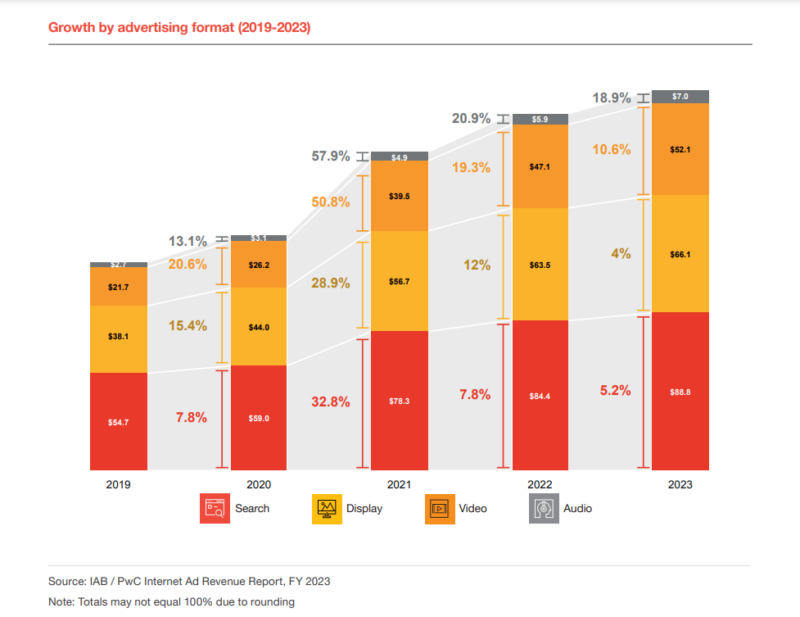

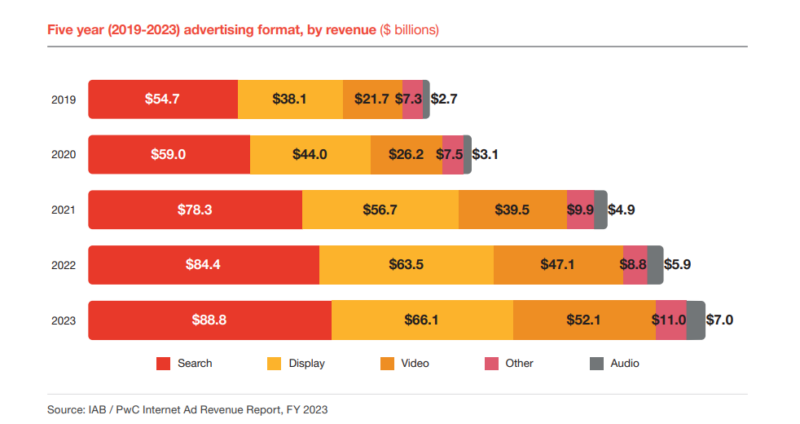

The IAB says in 2023, it saw an impressive 18.9% year-over-year increase, reaching a total revenue of $7 billion, up from $5.9 billion the previous year and more than double the $3.1 billion recorded in 2020.

Source: IAB / PwC Internet Ad Revenue Report, FY 2023

The IAB will release podcast-specific data in May and will delve into podcast-specific data. Still, the surge in spoken-word audio content has contributed significantly to digital audio’s revenue gains. Additionally, the IAB attributes this growth to more Americans embracing streaming services directly.

The annual report highlights, “Many services have expanded their audio subscription offerings and introduced ad-supported tiers, making subscriptions accessible to more listeners. AI-driven personalisation is also likely to be contributing to this growth.”

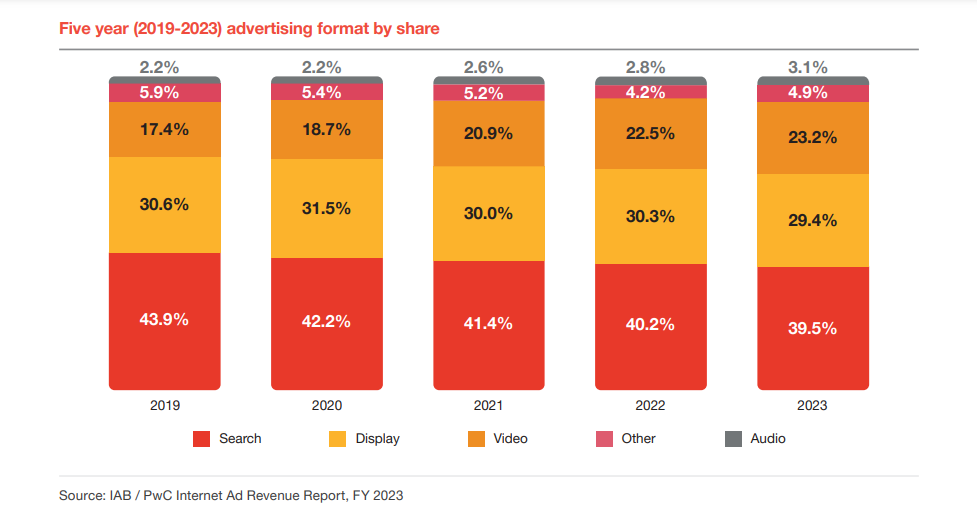

Despite its rapid expansion, digital audio advertising remains a relatively small slice of digital advertising pie. The report indicates that digital audio accounted for only 3.1% of the overall digital ad market in 2023, a notable increase from 2020’s 2.2%. However, its size suggests it will likely continue to benefit from double-digit growth in the current year.

Source: IAB / PwC Internet Ad Revenue Report, FY 2023

“Based on submission data, the outlook for 2024 remains positive, with all participating companies signalling that they anticipate growth in the year ahead,” the report anticipates.

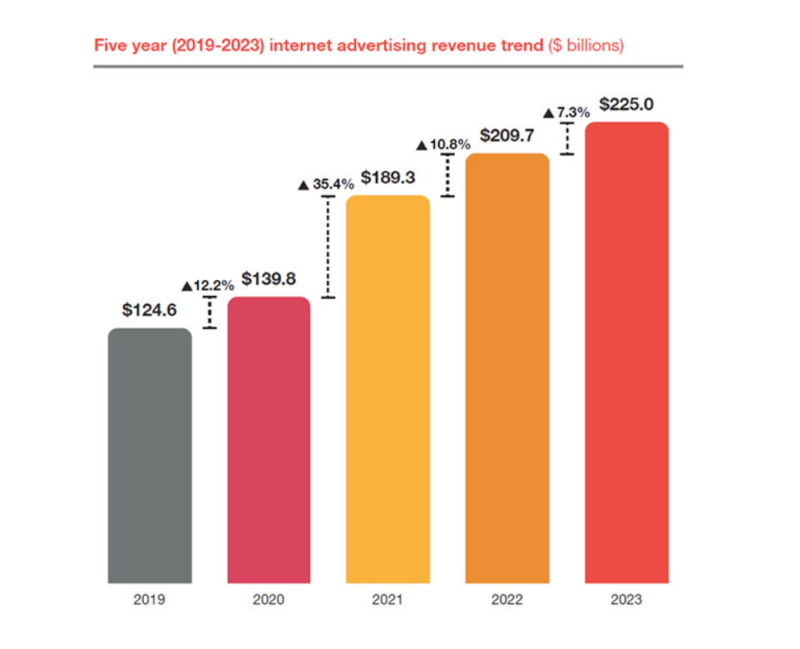

While digital audio advertising thrives, other internet advertising sectors also saw significant growth. Internet advertising revenue reached a record high of $225 billion in 2023, marking a 7.3% year-over-year increase. Despite challenges such as inflation and global unrest, the industry demonstrated resilience, with Q4 seeing the highest growth rate at 12.3% compared to the previous year.

Source: IAB / PwC Internet Ad Revenue Report, FY 2023

“Despite inflation fears, interest rates at record highs, and continuing global unrest, the U.S. digital advertising industry continued its growth trajectory in 2023,” said David Cohen, CEO, IAB. “With significant industry transformation unfolding right before our eyes, we believe that those channels with a portfolio of privacy by design solutions will continue to outpace the market. For 2023, the winners were retail media, CTV, and audio which saw the highest growth.”

“As more podcasters embrace video, they will enjoy an expanding ad market in that sector too,” the report notes. The IAB predicts that connected TV (CTV) and over-the-top (OTT) platforms will be the fastest-growing media channels in 2024, primarily as ad-supported tiers of significant streaming services capture more consumer attention.

In addition to digital audio, video advertising experienced significant growth, rising 10.6% to $52.1 billion in 2023. Social media advertising rebounded with an 8.7% year-over-year increase, while search and display advertising showed relatively modest growth rates.

Source: IAB / PwC Internet Ad Revenue Report, FY 2023

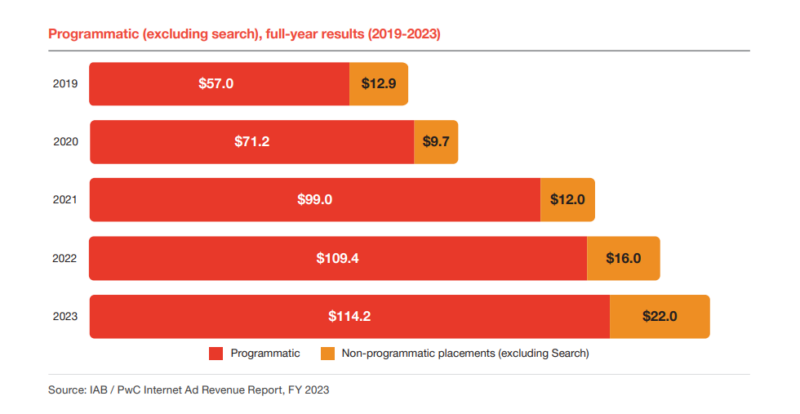

The growth of programmatic advertising remains steady, alongside an increase in revenue share for non-programmatic placements. Programmatic advertising revenue has risen by $4.8 billion since 2022, reaching $114.2 billion in 2023. Although this reflects a year-over-year increase of 4.4%, the growth rate has slowed compared to previous years. Possible factors contributing to this slowdown include a lack of competition, limited advertiser presence, and reduced pricing pressure.

Source: IAB / PwC Internet Ad Revenue Report, FY 2023

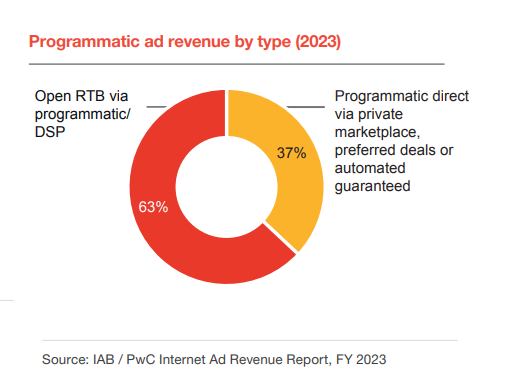

Survey respondents indicated that 63% of revenues originate from a programmatic marketplace, where real-time bidding (RTB) takes place and both advertisers and publishers have the opportunity to participate. The remaining 37% of revenue was generated through direct channels, including private marketplace, preferred deals, and automated guaranteed transactions.

Source: IAB / PwC Internet Ad Revenue Report, FY 2023

The report underscores the importance of privacy-preserving advertising practices and the adoption of innovative technologies like generative AI. Despite challenges, opportunities abound in sports streaming, creator-based marketing, and retail media networks.

“Looking ahead, while there are no shortage of challenges, there are also strong opportunities in sports streaming, creator-based marketing, retail media networks, and beyond,” said Jack Koch, Senior Vice President, Research and Insights, IAB. “2023 is proof that the industry can stay resilient in the face of change.”

As the advertising landscape continues to evolve, digital audio remains a potent force, demonstrating its ability to adapt and thrive in an ever-changing digital ecosystem. With promising growth prospects on the horizon, marketers and advertisers would do well to keep a close eye on this dynamic sector.

You can view the full report, “IAB Internet Advertising Revenue Report: Full Year 2023” here.

Source:

IAB website

IAB / PwC Internet Ad Revenue Report, FY 2023