The landscape of podcast advertising has seen significant shifts, as highlighted in the latest IAB U.S. Podcast Advertising Revenue Study for 2023. Prepared by PricewaterhouseCoopers LLP (PwC), the report quantifies the annual podcast advertising revenues and delves into growth projections until 2026.

Challenges and Growth Trends

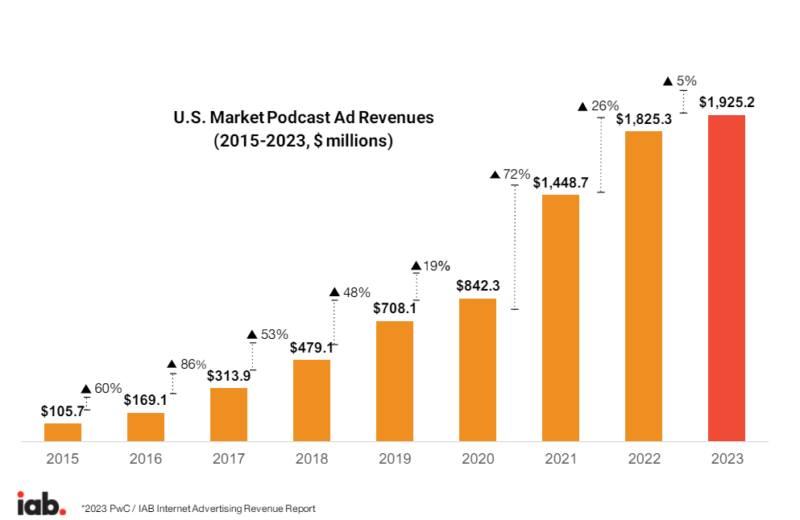

After experiencing robust double-digit growth for consecutive years, the podcast ad revenues saw a more tempered increase in 2023, marking a modest 5% uptick to $1.9 billion.

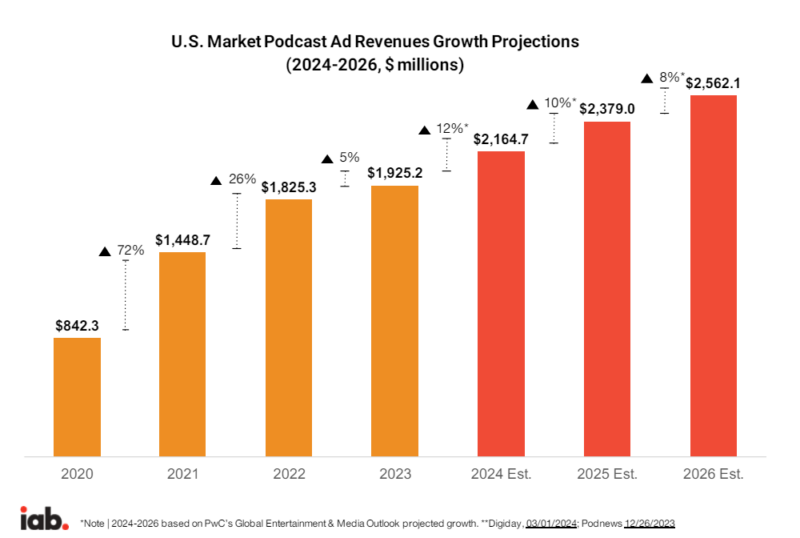

This slowdown was primarily attributed to the challenging advertising environment, particularly impacting mid-tier companies. However, industry experts remain optimistic, anticipating a return to double-digit growth of 12% this year, surpassing $2 billion in revenue. Projections extend even further, with expectations to reach nearly $2.6 billion by 2026.

“While a few of the largest podcast companies maintained double-digit growth, mid-tier companies hit a speed bump,” said Chris Bruderle, VP, Industry Insights & Content Strategy, IAB. “But revenue is already bouncing back.”

Driving Forces Behind the Growth

Publishers are anticipated to be pivotal in fueling this growth trajectory, employing various strategies such as enhancing measurement metrics, embracing programmatic advertising, organizing live events, intensifying content marketing efforts, and expanding into video podcast production.

Content Genre Dynamics

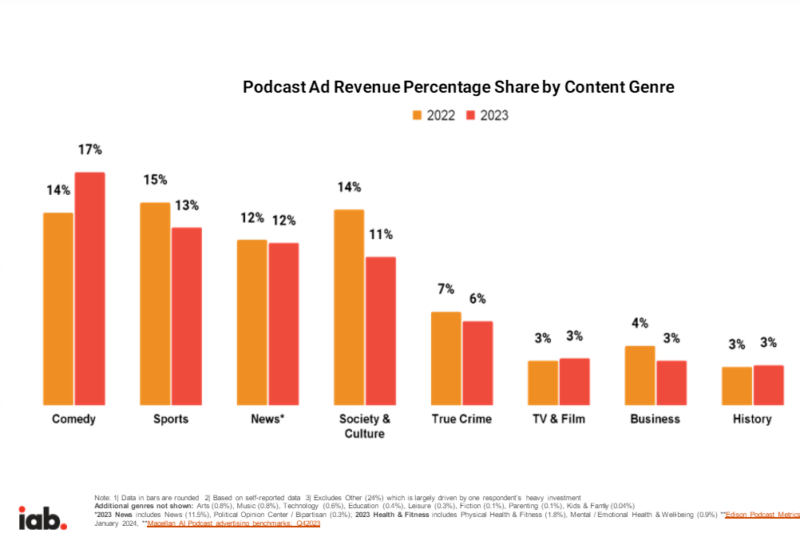

Comedy and sports have emerged as leading performers in the podcasting realm. Comedy, buoyed by shows from renowned comedic personalities, witnessed a significant revenue share increase over the past two years, surpassing news and sports. It now stands as the most-listened-to podcast genre, attracting 268 new advertisers in Q4 2023 alone. Sports, meanwhile, maintains its position as the second most popular content genre, signalling sustained interest among listeners.

Market Appeal and Diverse Offerings

One of the podcasting medium’s unique strengths is its ability to cater to diverse audiences and niche interests. This breadth of content offerings continues to attract advertisers seeking highly targeted avenues to engage with consumers. Despite smaller individual categories, collectively, they contribute significantly to the overall appeal of podcast advertising.

Looking Ahead

While the challenges of 2023 may have slowed the pace, the podcasting industry remains on a trajectory of growth and innovation. As audience measurement aligns more closely with other digital channels and with advancements in programmatic buying and video and live events integration, the future of podcast advertising appears promising.

Key takeaways

- After years of double-digit increases, 2023’s overall challenging ad market slowed podcast’s growth.

- Podcasting is projected to grow 12% to over $2B this year and reach nearly $2.6B by 2026. The programmatic evolution and new revenues from video and live events will help drive growth.

- A high volume of smaller categories continues to showcase the channel’s growth and appeal to a broad range of advertisers.

- Comedy and sports outrank news for the second straight year as production grows and listeners turn to lighter topics.

Download the full report to gain insight into podcast ad revenue trends and projections, breakouts by ad category and content genre, and for key industry developments and recommendations for how to capitalise on these trends.

Source: IAB website.